refi rates today: what savvy homeowners are seeing now

What moves the market

Refi rates today reflect a mix of inflation trends, Treasury yields, and expectations for Federal Reserve policy. Lenders also price based on your credit score, loan-to-value, occupancy, and whether you pay points or take lender credits. A headline rate can look great, but the true cost shows up in the APR and itemized fees.

- Compare at least three quotes on the same day and request identical terms.

- Review APR, discount points, and lender credits to see the real trade-offs.

- Calculate a break-even point: closing costs divided by monthly savings.

- Consider a shorter term or a no-cost option if you might move soon.

- Decide whether to lock or float based on timing and market volatility.

How to act now

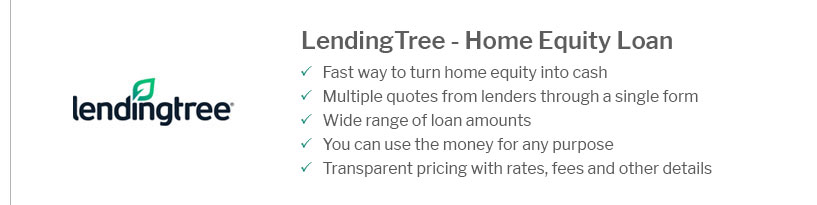

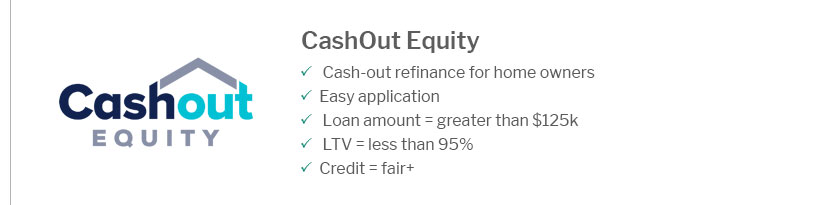

Gather pay stubs, W-2s, and mortgage statements to speed underwriting, and ask about appraisal waivers. If you need cash, remember that cash-out often prices higher than rate-and-term.

Watch debt-to-income and LTV; a small principal paydown can nudge you into a better pricing tier. Finally, check for prepayment penalties on existing loans, and confirm that any buydown makes sense within your expected time in the home.